Get The Numbers Right

Market-leading analytics for assets, deals, and portfolios — proven by evidence

Our Business

We’re the first dedicated quantitative analytics-as-a-service provider for energy and commodity trading.

We focus on what matters most: getting the numbers right.

Markets

Natural Gas: LNG, pipeline gas, hydrogen, ammonia

Oil and Products: Crude, refined products, LPG

Metals and Minerals: Base metals, rare earths, mining

Environmental: Carbon, weather-linked, insurance

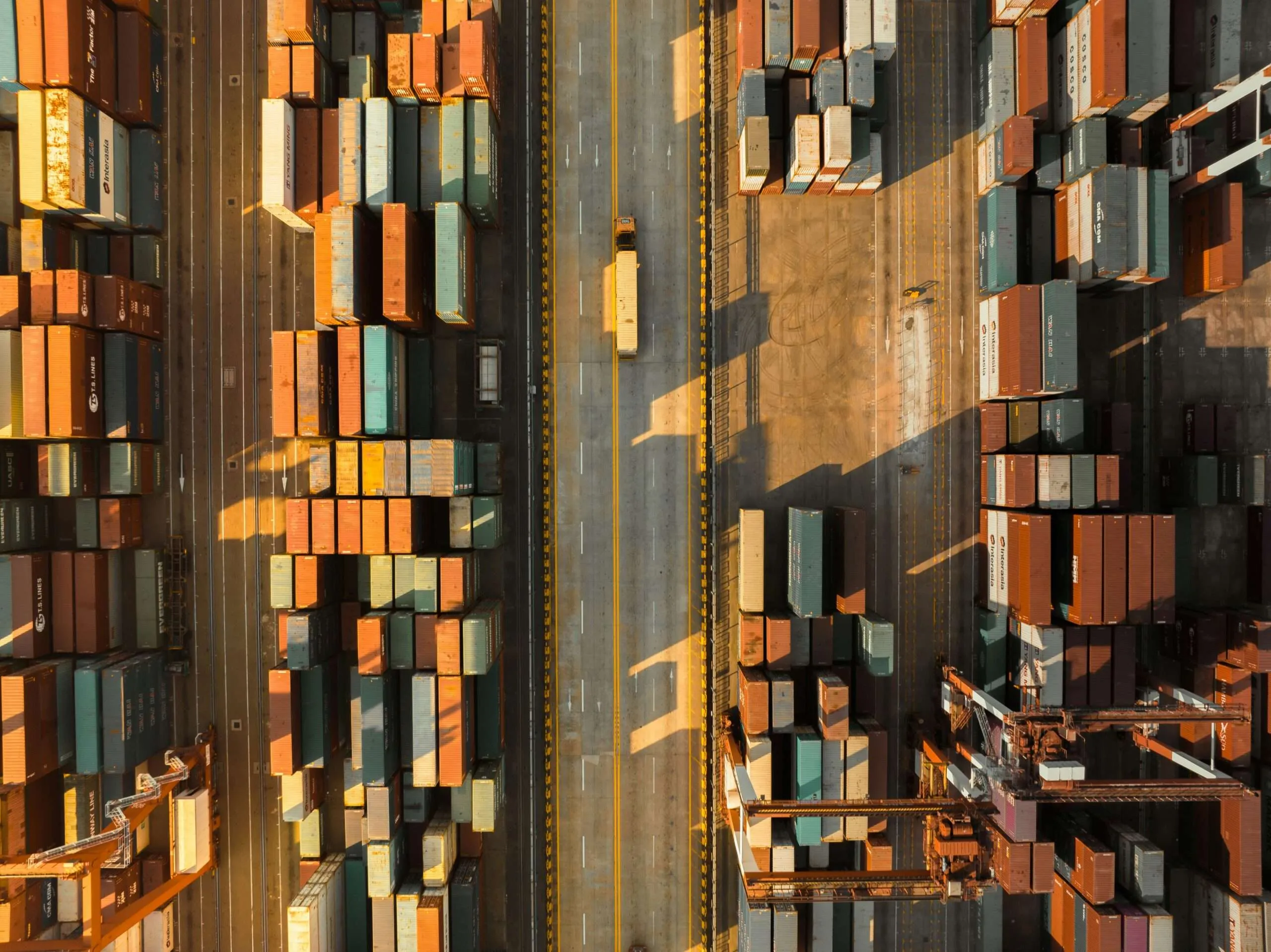

Freight and Shipping: Freight, time and voyage charters

Asset and Deal Types

LNG Assets: FOB, DES, contracts, regas, liquifaction

Transport and Shipping: Pipelines, port slots, charters

Swing and Storage: Volume flex, take-or-pay, indexation

Tolling and Processing: Refining, tolling, processing

Event-Linked: Weather, force majeure, caps/floors

Sales and Purchase: Long-term contracts, spot/indexed

Our Services

We specialise in price modelling, simulation, and valuation – covering deals, assets, and portfolios.

Our methods are market-leading, and our outputs are audit-quality: back-tested, benchmarked, and fully traceable.

Clients can understand the numbers—and stand behind them.

Price Modelling

Create realistic markets, simulate prices, spreads and forward curves

Asset Analysis

Value, risk, and optionality for assets and structured deals.

Portfolio Analysis

Quantify portfolio value, risk and composition

Our Deliverables

We can deliver analytics, models, or both.

Analytics: numerical analysis with clear, structured outputs – for valuation, risk and board approvals

Models: custom tools your team can run, reuse, and own – ideal for ongoing analysis and monetising assets

More detail

We tailor each project to your requirements, delivering either analytics, models, or both – depending on what you need.

Analytics

We deliver numerical analysis backed by market-leading methods. Outputs include data, spreadsheets, charts, and structured reports -in document or presentation format. Everything is traceable, benchmarked, and audit-ready.

Used for valuing, assessing risk, and managing or negotiating deals, assets, and portfolios.

Models

We build custom models that replicate or extend the analysis—giving you a tool your team can run, reuse, and adapt. Fully documented and ready for internal use.

Used for repeatable work, building expertise, and supporting trading, monetisation, and risk management of assets and portfolios.

Note: We deliver tailored models for clients to run and reuse in their own environment – not licensed software.

Get Started

Ready to get the numbers right?

Request a free consultation to discuss your deal, portfolio, and price modelling requirements.

How it works:

- Tell us your needs – submit your requirements

- We’ll be in touch – response within 48 hours